Politics investigations correspondent

Politics producer

BBC

BBCRachel Reeves has had a difficult start to her ministerial career.

As well as Labour’s new chancellor taking on the challenges of the UK economy, she has faced tricky questions about her past.

They began with scrutiny of her online CV late last year.

On the professional networking site LinkedIn, the Chancellor of the Exchequer claimed to have worked as an economist at Halifax Bank of Scotland (HBOS) immediately before becoming an MP.

One of those who challenged it was a retired former colleague, Kev Gillett.

In a public post on LinkedIn, which he asked followers to share, he wrote: “Back in 2009 Rt Hon Rachel Reeves worked 3 levels below me. Just facts. She was a Complaints Support Manager at LBG/HBOS. Not an Economist. #factcheck.”

In fact it emerged that she had worked in a managerial role within the bank’s complaint handling department and her LinkedIn profile was updated to remove the claim.

Gillett also made another claim about Reeves’s time at the bank from 2006 to 2009, writing that she: “Nearly got sacked due to an expenses scandal where the 3 senior managers were all signing off each others expenses.”

Reeves’s team vigorously denied the allegations.

However, Labour’s imminent victory in last summer’s general election prompted a post on a private Facebook group for former HBOS employees that BBC News has seen asking if anyone remembered Reeves.

One former employee replied: “the expenses dept certainly do!”

Several others made reference to Reeves being investigated over her expenses spending.

BBC News has been seeking the truth behind these suggestions, speaking to more than 20 people, many of whom were former colleagues, and gaining access to receipts, emails and other documents.

We have learnt that there was an expenses investigation into Reeves and two other senior managers.

A detailed six-page whistleblowing complaint and dozens of pages of attached evidence, which we have seen, raised concerns that the three managers were using the bank’s money to “fund a lifestyle” with allegedly inappropriate spending on dinners, events, taxis and gifts, including for each other.

We have not been able to establish what the final outcome of the investigation was. Indeed it may not have concluded.

But the initial part of the investigation, which was conducted by Internal Audit at the request of the bank’s risk department, found that the three managers appeared to have broken the rules and the whistleblower’s allegations were substantiated, according to a senior source with knowledge of the investigation.

A spokesman for Reeves said the Chancellor had no knowledge of the investigation, always complied with expenses rules and left the bank on good terms.

Banking career

Reeves was in her 20s and trying to become an MP when she took up a job at Halifax Bank of Scotland in West Yorkshire in 2006.

The role required her to move north from London, where she had unsuccessfully stood as Labour’s parliamentary candidate in what had been a safe Conservative seat.

She initially worked in the mortgage department, but in late 2007 moved to become Head of Business Planning in the Customer Relations department, which handled complaints.

Her career at HBOS coincided with what would prove to be a tumultuous time for the bank.

The global financial crisis which began in late summer of 2007 would force the sector to embark on a massive programme of job cuts and cost savings.

In September 2008, HBOS itself came close to collapse, requiring a government-brokered takeover by Lloyds and an emergency bailout which would total £20.5bn of taxpayers’ money.

It was shortly after this near-collapse, by early 2009, that a whistleblower from her department raised concerns about the spending habits of Reeves and two other managers, one of whom was Reeves’s boss.

Before this, in late 2008, a memo was circulated to Reeves and others which called for tighter cost control in the department.

Written by a planning and strategy manager, the document, “Financial Risk Control within Customer Relations”, raised concerns about “spending on travel” and on corporate spending cards, including Motivation cards which were used to reward staff.

It laid out proposals to “improve cost controls” which included monthly discussions with Reeves and another of the senior managers who the whistleblower claimed had mis-used expenses to “give visibility of claims, invoices, Thanks card use and reports”.

Separately, Reeves was emailed in mid-December 2008 about proposals for a presentation setting out how much had been spent on Motivation cards, recognising top performers and on taxi travel, to “focus attention on particular aspects of travel that are costly and perhaps need more consideration”.

Reeves replied to say that she was not sure a “huge analysis” was needed and she wanted to see the papers before they went any further.

Whistleblower complaint and investigation

The whistleblower’s complaint submitted by early 2009 was a six-page document laying out a range of concerns about an alleged spending culture in the Customer Relations department.

It focused on the behaviour of three individuals: Reeves, Reeves’s boss, and another senior manager in the department. Reeves’s boss, who we are not naming, was responsible for signing off the expenses of the other two managers.

The report and attached receipts and other documents seen by BBC News show Reeves was accused of spending hundreds of pounds on handbags, perfume, earrings and wine for colleagues, including one gift for her boss. Concern was also expressed about her spending on taxis and on a Christmas party. The whistleblower believed the spending to be excessive.

After a call to the whistleblowing hotline, the whistleblower was instructed to hand in a physical copy of their report and supporting evidence, two sources said.

A separate source, who contacted BBC News themselves in the wake of an article on the furore around Reeves’s CV last year, was also aware that someone had blown the whistle on Reeves and another colleague.

The report was passed to the bank’s risk department and, at their request, was taken on by the Internal Audit department.

A source who worked in risk at the bank told us: “Given the nature of the allegations – claiming expenses for things you wouldn’t normally claim expenses for – and the relative seniority of the individuals, the matter was referred for investigation by a team outside of that department.”

The Internal Audit department, which had access to expenses claims and sign-offs, then assessed the complaint and supporting documents, according to two sources.

It found that there was evidence of apparent wrongdoing by the three senior managers including Reeves, a senior source with direct knowledge of the investigation told BBC News.

Internal Audit completed its involvement in the investigation and passed its findings to an investigative part of the Risk department in around April 2009. The normal process would then have been for the managers to be interviewed about the allegations. There would then be an assessment of potential disciplinary action if necessary.

However it does not appear that this next interview stage took place, or that the investigation ever reached a formal conclusion. Reeves insisted she was never interviewed, as did her boss, who said she was “not aware of an expenses probe and my departure was not related to any alleged investigation”. The other senior manager declined to comment.

There is no evidence of which we are aware that the bank’s internal investigation was completed, or that there was ever a concluding finding of any wrongdoing.

Reeves left the bank in May 2009, as did her boss. The other senior manager was on sick leave in May and never returned to work at the bank.

There is no suggestion any of the departures were linked to the investigation or spending issues and a spokesman for Reeves said the Chancellor left the bank on good terms.

They also provided a statement from the lawyer who provided legal advice on the compromise agreement – a voluntary legal document ending an employee’s employment – she signed on her departure.

He said it was a “standard-style agreement adopted by the company when a mutually agreed exit was made during the bank’s restructure”.

“Absolutely no allegations of wrongdoing or misconduct were mentioned by the HBOS HR team during this process,” he said.

Expenses allegations

What lay behind the whistleblower’s complaint and the grumbles of other colleagues was unhappiness relating to several different areas of spending.

One concern was the use of bank payment cards to pay for Christmas and birthday gifts.

“A culture developed among senior managers in Customer Relations where gifts were given freely to direct reports – both upwards and downwards,” one former colleague of Reeves claimed.

“[They had] a very cavalier attitude regarding the budget in the department.”

Reeves and the other senior managers had both a corporate credit card and another payment card known as a ‘Motivation’ or ‘Thanks’ card.

The Motivation card was intended to be used to reward high-performers for good work.

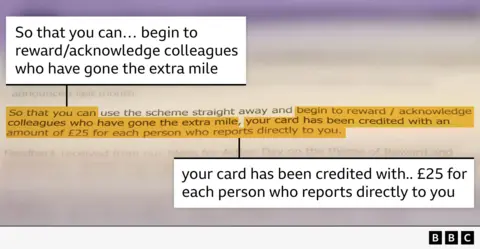

There was guidance about its use. In February 2008 a memo instructed HBOS employees on the correct use of Motivation cards, which were widely used within the Customer Relations department.

It stated that the cards were to be used to “reward/acknowledge colleagues who have gone the extra mile”.

Suggested gifts included “chocolates, flowers, wine, vouchers or you could simply log on and send a free e-card to say ‘Thanks’ for a job well done”, the memo said.

It warned that managers would be “responsible for all transactions on your card and will be held accountable if spending on your statement cannot be verified”.

Spending in this area was scrutinised because the company incurred tax on it.

The memo doesn’t explicitly prohibit Christmas and birthday gifts.

But 11 former employees told us they had never heard of colleagues being bought birthday gifts with the bank’s money, and believed that doing so was in breach of the rules. Several said any birthday gifts were bought with their own money.

However, one ex-staff member, Jane Wayper, a former HR business partner who was given permission to speak to us by Reeves’s team, claimed that “birthday gifts and Christmas presents could be purchased using Motivation cards” and “staff were encouraged to do so for their teams”.

Reeves bought birthday presents for colleagues with HBOS’s money throughout her time in Customer Relations, receipts show, with purchases including wine and cosmetics. Some were bought using a Motivation card, while others were reimbursed through an expenses claim.

She also spent £152 on a handbag and perfume as a present for her boss using the bank’s money, according to the whistleblower’s report. The present was a joint gift from Reeves and one of the other managers who was later investigated alongside her.

And she bought earrings as a present for her PA, which she claimed back on expenses.

Her PA, Linda Barrowclough, said she had received Christmas and birthday gifts from Reeves but had assumed they were “personal gifts [and] they’d have come out of her own pocket”.

Reeves also used her Motivation card to spend more than £400 on a leaving meal for a colleague, which the whistleblowing complaint claimed was not a permitted use.

Christmas gifts

The situation around Christmas gifts, which Reeves also bought for her PA and others, was more complicated.

That’s because, according to internal bank guidance we have seen, these could be bought on expenses providing they were small gifts of £25 or less and they were not bought using the Motivation card.

The £25 limit was based on tax advice as anything more substantial would attract tax.

It appeared to her colleagues that Reeves had broken these rules.

But there does appear to have been confusion about the policy. We have also seen emails showing that Reeves was encouraged by her boss to buy more expensive Christmas presents, and to pay for them with her Motivation card.

In late October 2008, Reeves’s manager wrote that “after checking with other departments, it looks like the standard practice of buying Christmas gifts for direct reports using motivation bank will continue this year”, emails seen by the BBC show.

She suggested spending £50 to £75 per person on the presents.

A reminder titled “further clarity” about how to buy Christmas gifts and how much to spend was circulated by another HBOS employee in early December, emails show.

Reeves and the other managers who were later investigated were all among the recipients of this email confirming the rules on Christmas gifts.

While seasonal gifts, such as at Christmas, were allowed, the managers were explicitly told they could not use Motivation cards for these purchases. The cost of these “trivial” gifts was also not allowed to exceed £25, in line with HMRC guidance, the email said.

This is because rewards for performance at work are taxable whereas seasonal gifts such as those given for Christmas, providing they are not too costly, are exempt.

Replying to the email, Reeves wrote that she didn’t understand why the “goal posts are shifting” and said she had already ordered and paid for her presents using “Motivation Bank/Thanks, and I do not intend to cancel them,” claiming this would cost more time and money.

A colleague responsible for finance acknowledged that the message on paying for Christmas gifts hadn’t always been clear but said: “I don’t believe that the goalposts are being moved.”

Receipts show that gifts bought by Reeves at Christmas 2008 included a £49 handbag for her PA, while she herself received £55 worth of wine from her boss.

Open secret?

There was a widespread belief at the bank that there had been an expenses investigation into Reeves and two colleagues.

But Reeves has said that she has no recollection of being investigated or having questions raised over her expenses.

A spokesman for Reeves said she was “proud of the work she did at HBOS” and was not aware of the claims about her expenses until approached by the BBC.

“She was not aware of an investigation nor was she interviewed, and she did not face any disciplinary action on this or any other matters. All expenses were submitted and signed off in the proper way,” she said.

The spokesman also said Reeves left in 2009 “on good terms and received a severance payment, including her full notice pay and bonus”.

“HBOS allowed her to keep a company car for six months after she left and she was given a favourable reference.”

Reeves’s team put forward several formal HBOS employees for interview who they said corroborated her account that she had not been investigated.

One said she hadn’t seen evidence of senior managers misusing expenses and the bank had controls to prevent it but she left in February 2008, more than a year before Reeves departed. She also said that she had never heard of giving birthday and Christmas gifts at HBOS’s expense as being part of the bank’s policies.

Another, Jane Wayper, the former HR business partner, said in a statement that she didn’t recognise the accusations against Reeves and “would have been aware of any investigation which concluded there was a case to answer” as she would have been involved in the disciplinary process.

She said there was “extensive oversight of all expenses policies” and claimed that “birthday gifts and Christmas presents could be purchased using Motivation cards”. But this is at odds with a document seen by BBC News and the testimony of 11 sources we have spoken to.

Many of Reeves’ former HBOS colleagues were worried about the consequences of sharing confidential information with BBC News but believe it is in the public interest for what happened, and their concerns about the now-Chancellor’s spending of the bank’s money, to be reported.

But, given their concerns about speaking out publicly, we have agreed not to name them.

A Downing Street spokesman said the prime minister had no concerns about Reeves’s conduct.

Asked whether Sir Keir Starmer still thought the Chancellor had integrity after she updated her career history on LinkedIn, his official spokesman said: “Yes. The Chancellor and the prime minister are working hand in hand to deliver on the priorities, the plan for change, and to deliver the higher growth and the improvements in living standards that the country needs.”

The Number 10 official added that the chancellor had gone through the declaration process, which all members of Cabinet go through, when asked if she disclosed that there had been an investigation into her expenses before she was an MP.

Conservative leader Kemi Badenoch said the investigation raised questions for the chancellor.

She posted on X: “Keir Starmer said ‘restoring trust in politics is the great test of our era’. Until she [Reeves] comes clean – not just about her CV but about the circumstances in which she left HBOS, no one will take him seriously.”

The investigation at HBOS was not the last time Reeves would face scrutiny over her expenses.

In 2015, it emerged that she was among 19 MPs who had had their official credit cards suspended by the parliamentary expenses watchdog after failing to show their spending was valid.

Reeves owed more than £4,000 in spending at the time when her card was blocked. She subsequently cleared her debt.

If you have any information on stories you would like to share with the BBC Politics Investigations team, please get in touch at [email protected]